About a decade ago, someone asked our CEO how much of Knight’s $2.1 billion (at the time) endowment was managed by financial firms owned by women and people of color. We looked it up. It was $7.5 million, just 0.35%. Given Knight’s core belief in supporting engaged, equitable and inclusive communities, this was unacceptable. So, we made deliberate changes in how – and with whom – we invest. Today, 42% of Knight’s U.S. based assets, or about $931 million, is managed by diverse-owned firms.

In 2017, Knight began publishing research on the state of diversity in the asset management industry. We released updated research in 2019. Today, we publish the latest data on the state of diverse ownership in the asset management industry. While we still see only slow, nominal change in the extent to which U.S. based assets are managed by diverse-owned firms, we continue to confirm, now for the third time in four years, that firms owned by women and people of color perform just as well as their less diverse peers.

While our country has always been diverse, that diversity is not adequately reflected or represented in our financial system. Diversity shapes the future of our economy. Different viewpoints help assess risks, opportunities and unseen possibilities in traditional and emerging markets. By diversifying who manages our nation’s wealth, we can better tap unforeseen opportunities and build a more equitable and prosperous future for us all.

Executive Summary

Introduction

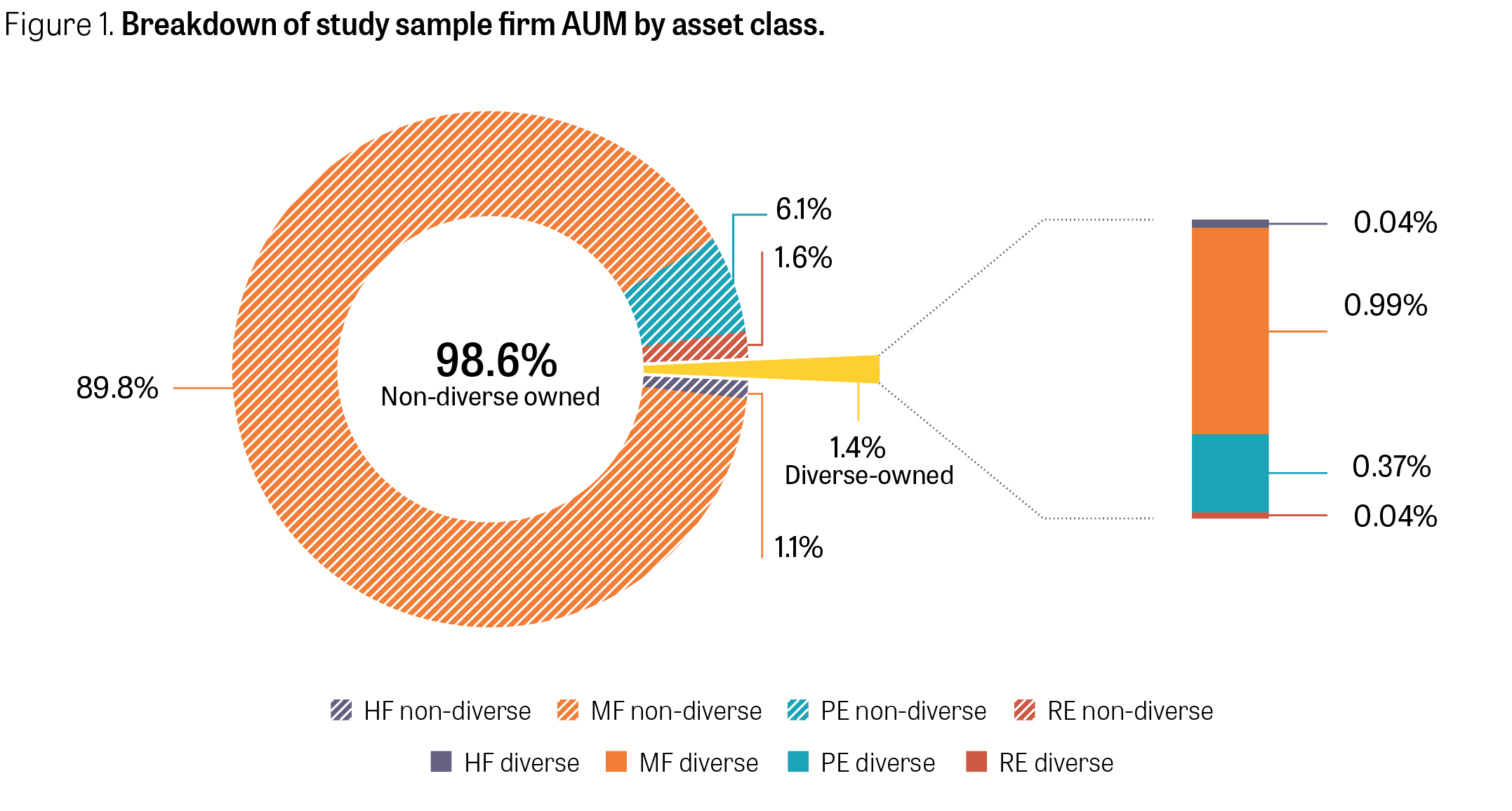

The asset management industry is a cornerstone of the economy, facilitating the movement of capital from investors to entrepreneurs, growing ventures and restructuring enterprises. The present report studies diversity in the U.S.-based asset management industry, using a sample representing $82.24 trillion USD in assets under management (AUM)1. Our analysis finds that only 1.4% of total U.S.-based AUM in our sample is managed by diverse-owned firms as of September 2021. Despite the size and importance of the industry, many observers have pointed to its lack of diversity.2 To address this concern, the John S. and James L. Knight Foundation commissioned Bella Private Markets to study diversity within the ownership ranks of U.S. asset managers in previous reports published in 2017 and 2019. These previous two studies concluded that women and minorities were dramatically underrepresented3 in the mutual fund, hedge fund, private equity and real estate industries.

In this report, the Knight Foundation, along with Professor Josh Lerner of Harvard Business School and Bella Private Markets, builds on these previous studies by using up-to-date data and refined methodologies.

As in our prior studies, we focus on the U.S. market and study four major asset classes: mutual funds, hedge funds, private equity and real estate. A breakdown of our sample by asset class in terms of total firm assets under management (AUM) is provided in Figure 1.

The study has two primary objectives:

- Representation: To better understand the representation of ownership diversity among U.S. asset managers and the AUM levels of minority-owned, women-owned and other asset managers.

- Performance: To examine the impact of diverse ownership on financial performance.

Representation

We find that across asset classes, minority- and women-owned firms are underrepresented relative to other firms. Note that this report uses a definition of “minority” that includes racial/ethnic minorities (i.e., Hispanic, Black, and Asian), but does not include other underrepresented groups such as veterans or disabled persons. Occasionally, we use the term “diverse-owned” to refer to the broader group of women-owned and minority-owned firms. Note that firms may be classified as both women-owned and minority-owned.

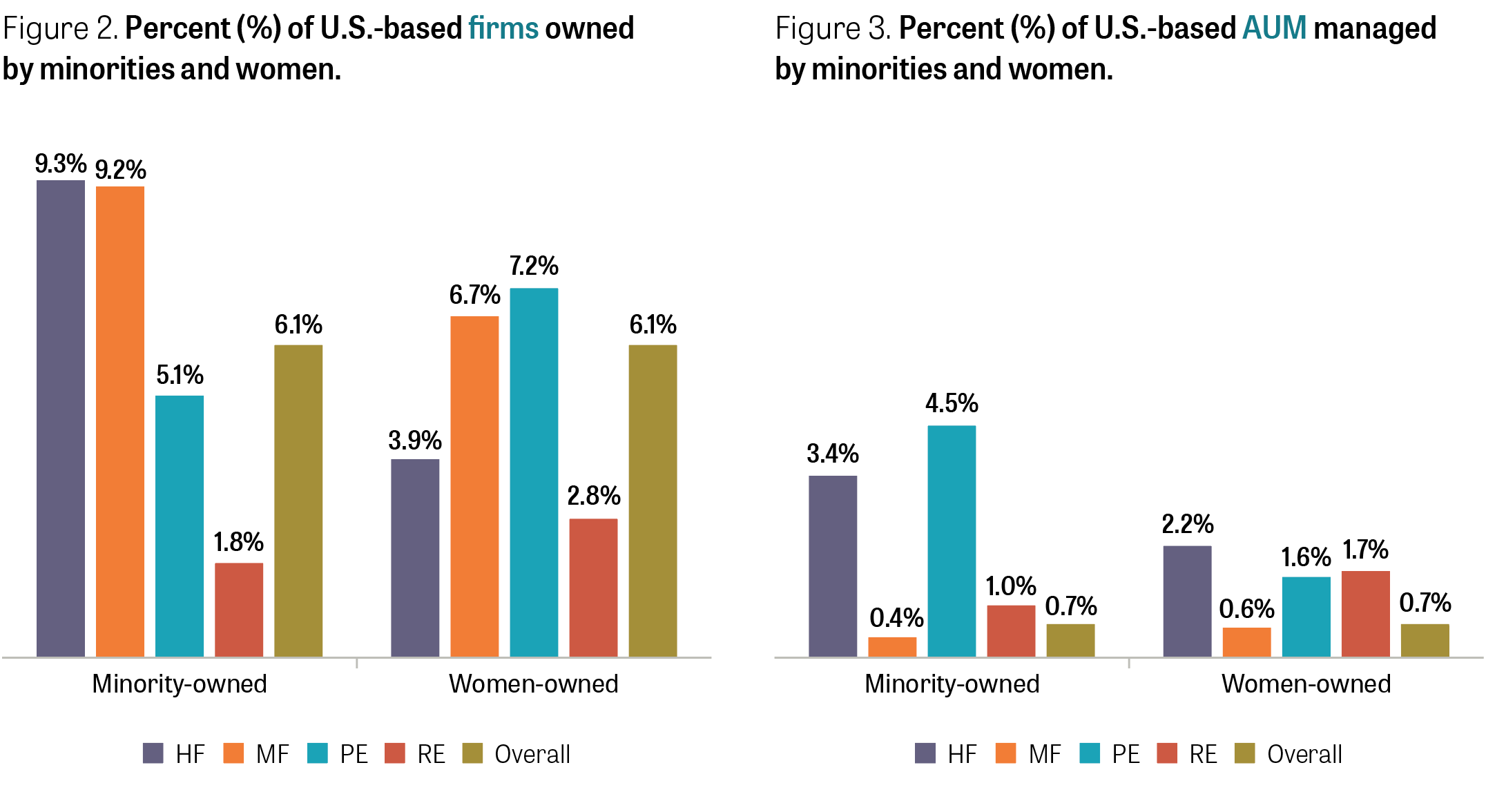

First, when looking at the number of U.S.-based minority-owned firms within each asset class, we find the highest representation among hedge funds and mutual funds, in which 9.3% and 9.2% of firms are minority-owned, respectively. For women-owned firms, we see the highest representation among private equity and mutual funds at 7.2% and 6.7%, respectively. In real estate, we see the lowest representation of both minority- and women-owned firms. Viewing the data holistically, we find that the overall percentage of U.S.-based firms owned by minorities is 6.1%, while women ownership at the firm level is also at 6.1%.

Moreover, we find that there is even greater underrepresentation in the amount of capital controlled by these groups. For instance, despite representation of minority-owned firms being relatively high in the mutual fund industry, at 9.2%, when we instead consider AUM, we see much lower minority representation in mutual funds––only 0.4%. This would suggest that although there may be a relatively large number of minority-owned firms, the size of these firms (as measured by AUM) is much smaller than their non-diverse-owned peers. In fact, we see the same trend across all asset classes: the amount of capital managed by diverse-owned firms is not proportional to the number of diverse-owned firms. Overall, the percentage of AUM managed by minority-owned firms across the asset classes in our sample is 0.7%, while the percentage for women-owned firms is also 0.7%. The overall percentage of AUM managed by diverse-owned firms (i.e., firms that are minority-owned, women-owned or both) in our sample is 1.4%.4

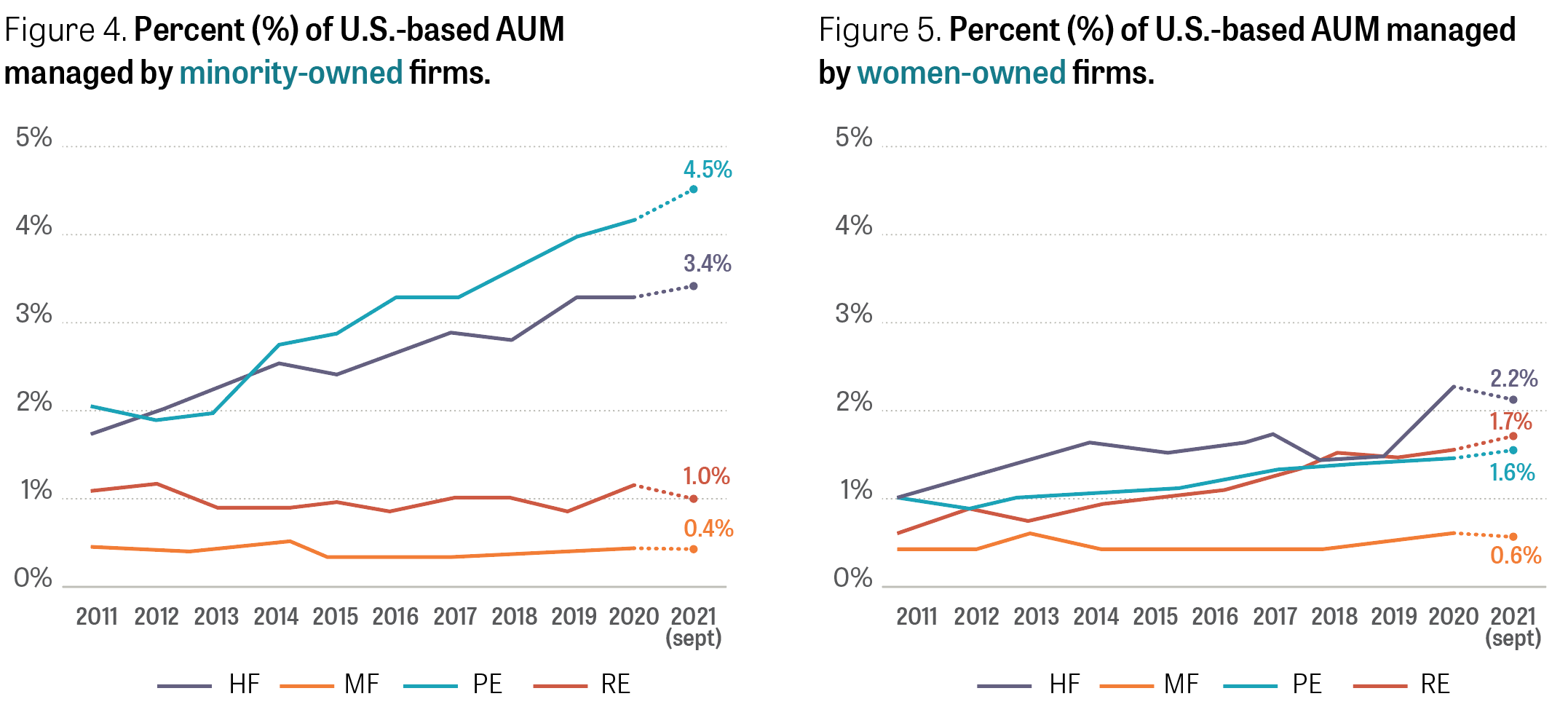

We also examine the trends of these ownership metrics over time. In short, although representation still lags across these four asset classes, diverse representation in terms of AUM has increased over time, particularly for private equity and hedge funds.

Figures 4 and 55 reveal some promising trends in diverse representation across asset classes. Namely, the representation of minority- and women-owned AUM has generally increased in recent years. This is encouraging, particularly given that the size of these asset classes overall has grown. This suggests that not only is diverse representation improving, but diverse-owned AUM is increasing even more than non-diverse-owned AUM across asset classes––a finding we delve into further in the main report.

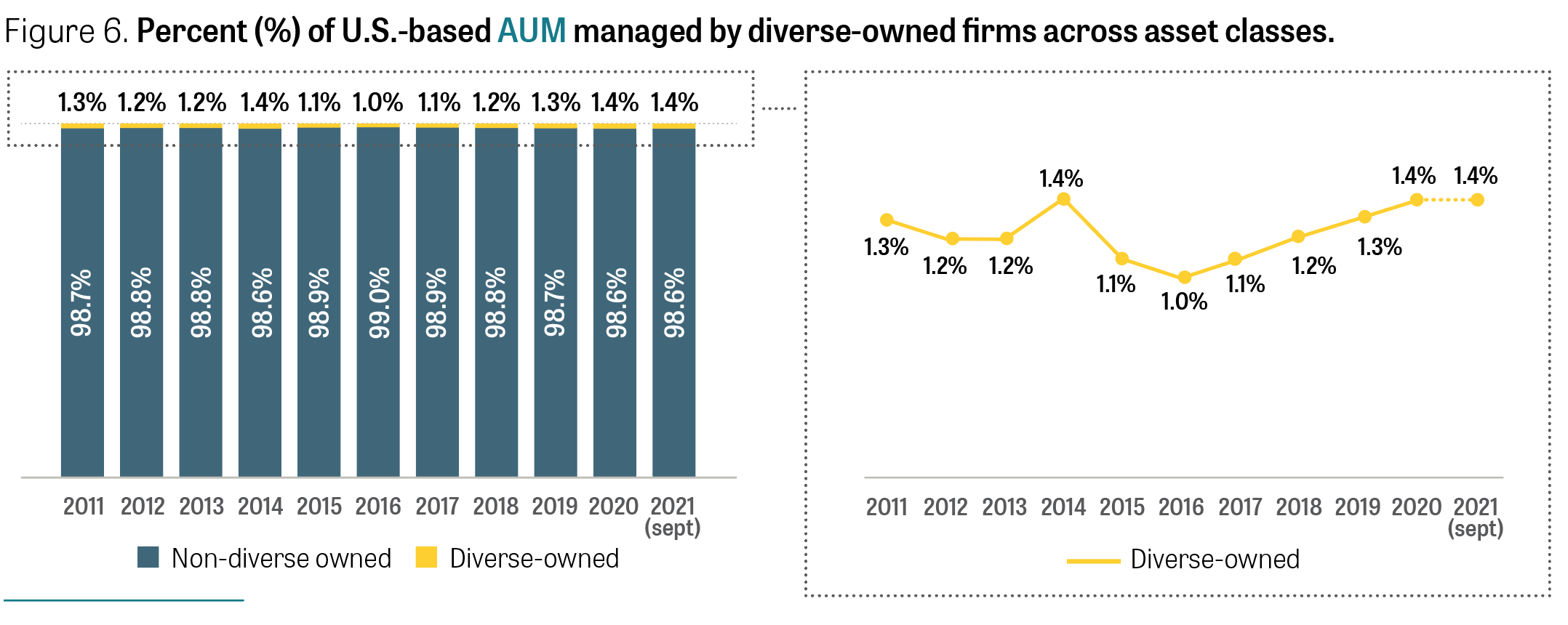

Indeed, taking a bird’s-eye view and considering the trajectory of AUM managed by diverse-owned firms across all asset classes for the past five years, we can see from Figure 6 that the picture is one of gradual, short-term growth. The percentage of diverse-owned AUM grew from 1.0% to 1.4% between 2016 and September 2021.6 However, growth is flatter if we consider the past decade in its entirety, with only a 0.1% increase between 2011 and September 2021. Furthermore, the nominal amount of AUM managed by diverse-owned firms still pales in comparison to that managed by non-diverse-owned firms: as of September 2021, the total AUM of non-diverse-owned firms across these four asset classes amounted to $81.05 trillion, compared to $1.19 trillion of capital managed by diverse-owned firms.

Please note that when comparing these figures to those from the previous study, the value for 2017 (when the last data were gathered for the report published in 2019) will be slightly different due to methodological changes. Namely, in this report, we define a woman- or minority-owned firm to be one that is 50%+ owned by women or minorities, respectively, and we define a diverse-owned firm to be one that is women-owned, minority-owned or both.7 We use this threshold across all asset classes for consistency. In the previous report, some asset classes used a lower threshold, which made comparisons across asset classes somewhat more difficult. Furthermore, the values in Figure 6 (as well as those throughout the report) were arrived upon using updated databases, and any disparities between the previous and current report will reflect changes to the historical data over time. Such changes may include expanded historical coverage or retroactive updates to the data, a topic we analyze briefly in the Appendix.

Performance

One criticism historically raised against minority- and women-owned firms is that there exists a performance differential between these firms and their peers––a potential explanation for the underrepresentation of investing in minority- and women-owned firms. Therefore, this report seeks to identify and quantify any performance differential between minority- and women-owned firms and their peers.

To do this, we employ robust statistical techniques––chiefly, linear regression analysis. Unlike simpler approaches to benchmarking performance (such as comparing simple mean and or median performance metrics), this method allows us to account for a variety of confounding factors––for instance, fund size, market conditions or time period––and thus isolate and quantify the performance difference attributable to a firm being women- or minority-owned specifically.

Using the final specifications of the regression models that we test, we ultimately find no statistically significant differences in performance between diverse- and non-diverse-owned funds across asset classes. While some models will show some differences in performance among groups (with ambiguous directionality) due potentially to random chance or spurious correlation, the central story from these models is that performance is empirically indistinguishable among minority-owned, women-owned and other firms.

Concluding remarks

Our findings regarding diverse-owned asset managers are broadly consistent with previous research on diverse-owned funds. We find that, for most asset classes, diverse-owned firms have low levels of representation across each asset class; however, they exhibit returns that are not significantly different than non-diverse-owned firms.

Despite lower representation, we do see some encouraging signs of increasing representation across asset classes in terms of number of funds, number of firms and amount of AUM, particularly in the past five years. Moreover, we also find that data quality has improved over time––for example, through more systematic reporting of private equity diversity data––perhaps reflecting a sharper focus being brought to bear upon this important issue.

Download the full report

Knight Diversity of Asset Managers Research Series

It started with a tough question and an unacceptable answer. In 2010, Knight Foundation leadership was asked how much of its multibillion-dollar endowment was invested with diverse-owned firms, meaning firms owned by women and people of color. When we looked at the data and the demographics, the results revealed that we were not living one […]

Asset Management Industry Severely Lacking Diversity, New Knight Foundation Study Finds; Signals Untapped Opportunity For Investors

Knight-commissioned research reveals only 1.4% of more than $82 trillion dollars of U.S.-based assets is entrusted to diverse-owned firms MIAMI – December 7, 2021 – The John S. and James L. Knight Foundation released a new study today measuring diversity in the U.S.-based financial industry revealing that only 1.4 percent of assets are entrusted by […]

Diversifying Investments: A Study of Ownership Diversity and Performance in the Asset Management Industry

Research across a multitude of fields and industries has identified the potential economic and social benefits of diversity. Yet the asset management industry continues to struggle with a lack of diversity. Research studies and articles have consistently documented the low level of representation by women and racial/ethnic minorities among asset managers. Analyzing and exploring diversity […]

Diversifying Investments

A study of ownership diversity in the asset management industry