Education series provides angel investors with clearer picture of Miami startup market

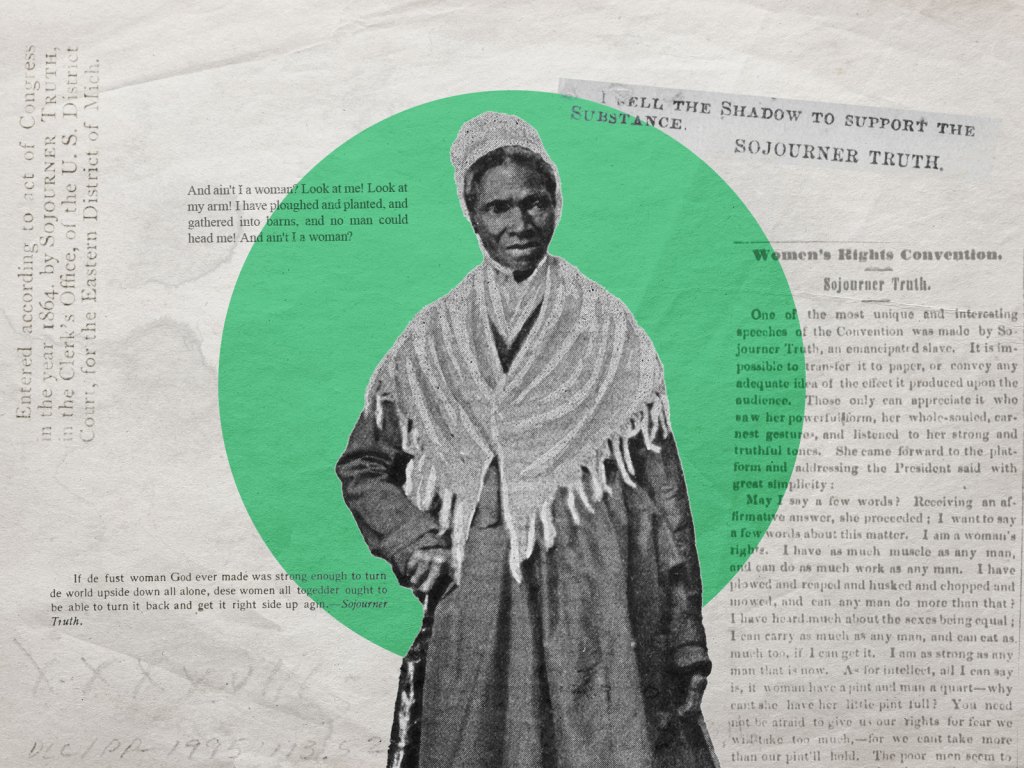

Photo credit: Michael D. Bolden on Flickr.

“I know it’s a cliché, but we are back by popular demand,” said Nico Berardi, managing director of Accelerated Growth Partners, opening the second Angel Education Series at Northwestern University’s Kellogg School of Management campus in Coral Gables, Wednesday.

“We had six sessions at the beginning of the year … and the feedback we got from everyone that attended was, honestly, better than expected,” Berardi said. “We thought of it as an experiment. There is something really interesting happening in Miami and we want more people to be part of it. So what happens if we start shooting information and know-how to the broader community? And we got such a cool response that we said, ‘Let’s do this again.’”

Organized by Accelerated Growth Partners, a Miami-based angel investors network funded by Knight Foundation, the six-workshop series is also supported by Greenberg Traurig, Northwestern University’s Kellogg School of Managementand the Miami Finance Forum. While startup activity in South Florida continues to grow, access to capital remains a challenge for entrepreneurs seeking to scale their ventures. The reason, observers agree, is not lack of money or savvy investors in South Florida, but the fact that many of these investors are new to angel investing and tech startups. The series aims to provide potential investors with some basic resources and a clear picture of the local market.

“We did [this series] because there is a need and there’s not a lot of people educating the community on angel investing, which is a critical stage after friends and family,” said Carolina Piña, former director of Kellogg School´s Miami Campus and now a special adviser to the program. “When you look at the local ecosystem, one of the things people continue to talk about is lack of funding and talent. By addressing angel investing we are addressing the funding component and, hopefully, making it stronger.”

Wednesday’s two-hour session, titled “Business Due Diligence,” was led by Marco Giberti, founder of Vesuvio Ventures, and Thomas “Tigre” Wenrich, principal at Miami Venture Advising. The series continues Nov. 11 with “The Entrepreneur View” hosted by Emiliano Abramzon, co-founder of NearPod, and Barry Stamos, co-founder of Videoo.

Other sessions in this second series will address “Due Diligence” (legal); “Sector Analysis” (education and health care); and “Funding Cycle.” The subjects complement topics addressed in the education series earlier this year.

Another point of emphasis for Piña is creating more opportunities for women. It’s not by chance that a session of the series focuses on “Women in Angel Investing.” Of the 80-plus people in attendance last Wednesday, only seven were women. “Empowering women and female leadership is critical for me, “ said Piña. “The data shows that women are better investors, but you saw how many we had today. We have made progress, but we have ways to go. Last night there was an event of venture women at Rokk3r Labs, and there were about 20 of us; we want to make sure we are supporting each other and supporting the ecosystem. ”

On Wednesday the presentation zigzagged from the general and philosophical to the practical. The speakers emphasized the practical early, as the first request from the audience was for them to address the mistakes they had made as investors.

Both Giberti and Wenrich emphasized focusing on the founders rather than on PowerPoint presentations, numbers and projections. “Don’t buy the idea because it’s going to change,” warned Giberti. As an example he spoke about one of his successful investments: “The company they sold me when I invested is no longer the company that exists today. They changed the idea at least two or three times.”

But as useful as the series advice may be, for many, important conversations will happen before and after the presentations. Before starting his talk, and to get a sense of who was in the audience, Giberti asked for a show of hands, revealing a mix of entrepreneurs, novice and experienced investors as well as other professionals.

As Wenrich underscored in his presentation, “It’s much easier, and it’s much better, to do [angel investing] in groups, with colleagues, because you can spread your money in many more businesses, which is the most important principle here. I [would] rather see you put $10,000 each in 10 companies than $100,000 in one. But also because doing it alongside other people you make better decisions and you can leverage all the people’s networks and knowledge.”

In fact, Giberti, a member of Accelerated Growth Partners’ board, in a conversation after the talk, said that “what we are trying to do with Accelerated Growth Partners, and places like The LAB [Miami] and Venture Hive is to create meeting opportunities for the right people to get together: investors, mentors and entrepreneurs.” It’s a strategy that Knight Foundation has used in its investments in the Miami startup community over the past three years, cultivating events and other opportunities for innovators and entrepreneurs to connect and share ideas.

“Today, we had more than 80 people at this session and probably 55 of them are going to start thinking ‘Okay, I can do this in Miami. I want to connect with [Accelerated Growth Partners] or Knight Foundation, the Hive or any of the initiatives that are around.’ And that’s the goal. The more active investors, the better entrepreneurs we are going to be able to back and attract.”

Early in his talk, Giberti personalized his interest in developing a healthy entrepreneurial ecosystem in South Florida as he mentioned discussions with friends about how “all our kids are trying to go to Boston or California.”

“These 20-somethings don’t think that they can build a business in Miami,” said Giberti. “They think that if they want to launch a business, they have to be in New York or in San Francisco, and we want to create the mindset that if you want to start a business, you have the infrastructure, the ecosystem in Miami to do that. Today it’s not perfect, but you have many pockets of potential support … and it’s getting better and better. I’m really bullish about this.”

Fernando González is a Miami-based arts and culture writer. He can be reached via email at [email protected].

Recent Content

-

Community Impactarticle ·

-

Community Impactarticle ·

-

Community Impactarticle ·