Silicon Valley to Miami: Back passionate entrepreneurs with dollars

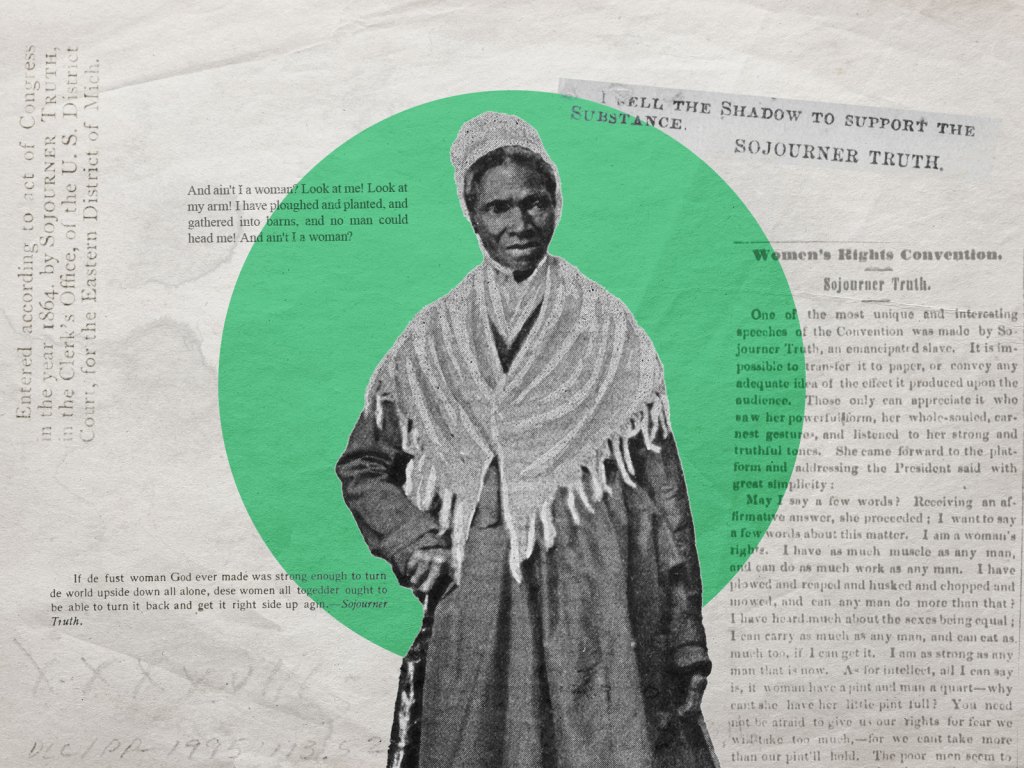

Miami’s leading investors and entrepreneurs met in Key Biscayne Sunday night. Panelists spoke about what needs to happen to make the the city’s high-net-worth investors participate in the entrepreneurial ecosystem. They included (L to R) Bedy Yang, managing partner of 500 Startups; Juan Diego Calle, chairman of STRAAT; Juan Pablo Cappello, co-founder of Private Advising Group; Peter Kellner, co-founder and board Member of Endeavor Global; Andrés Moreno, founder and CEO of Open English; and Dave McClure, founding partner of 500 Startups. Photo by Preston Tesvich.

Sunday evening, more than 100 of Miami’s leading entrepreneurs and investors gathered at the home of STRAAT Chairman Juan Diego Calle in Key Biscayne to discuss what it means to put dollars behind passion in Miami’s growing entrepreneurial ecosystem.

The event, sponsored by Knight Foundation, was hosted by the international startup accelerator 500 Startups. Founding partner Dave McClure announced that the group is expanding its Pre-Money Conference to Miami at the end of March. The conference brings emerging venture capitalists into conversation with leading angel investors to explore opportunities for investment as well as effective strategies for scaling venture portfolios.

McClure asked that each attendee consider the possibility of partnering with 500 Startups in their effort to raise an additional $10 million to $50 million and grow Miami as a regional vehicle for global innovation. He said the accelerator has invested $125 million in 950 startup companies across in the last five years and that its largest capital gains continue to be made in emerging markets such as Miami. Of those investments, he emphasized that 30 percent were made in Latin America.

“The venture community here needs to be awakened and see the opportunities that exist here in Miami, a gateway to Latin America,” he said. “We want to encourage the growth of the emerging market that exists in Miami and Latin America with the help of partners, angel investors, [venture capitalists] and the public sector.”

He said 500 Startups plans to host regular VC101 events designed to help venture capitalists become more familiar with how to go about investing money in an emerging tech community. McClure said that it is important for the local government, venture capitalists and angel investors to understand how “deal flow,” the rate at which they receive proposals, works. Currently, he said Miami’s investors tend to make one to two large-scale investments each year. Big exits or higher-performing portfolios, however, require that an investor make roughly 20 investments each year.

Following the announcement, 500 Startups Managing Partner Bedy Yang moderated a panel with leading Miami investors.

“Everyone is happy with the energy in Miami’s ecosystem,” she said. “The key question here today is what specifically is actionable in terms of making people invest more here in tech and in venture?”

Martin Varsavsky, CEO of Fon and a speaker last week at the SIME MIA digital business conference in South Florida, spoke about how to identify what companies are worth the investment. He warned Miami investors and entrepreneurs to avoid competing with Silicon Valley.

“You can be shouting,” he said, “But Silicon Valley is holding the microphone — even when your product is better than theirs. However, if you have something that is different you have a good chance.”

Varsavsky, who now owns a home in Miami, said he also told the crowd to start claiming their already-existing assets. He said that Miami has a loyalty that sets it apart from other tech ecosystems. In addition, he said the rumors that there is no series A funding in Miami can now come to a halt since Google just made a $542 million investment in wearable technology company Magic Leap, whose products may one day replace the touchscreen and PC monitor.

“If [Magic Leap board members] are willing to come to Miami, then I think anything can happen in Miami,” he said.

Diego Calle, who hosted the discussion, encouraged 500 Startups to continue conversations that yield a more standardized way of talking about contracts and investment. He said that he is eager to learn more once Miami standardizes its own legal and entrepreneurial language, and that the size of the crowd in his own backyard is a testament to how far Miami has come.

“Four years ago, this was unthinkable,” he said. “Here we can see there is interest from the community to learn about investing and interest from entrepreneurs to learn about how to go about getting that support and funding.”

Jenna Buehler is a Miami-based freelance writer.

Recent Content

-

Community Impactarticle ·

-

Community Impactarticle ·

-

Community Impactarticle ·