A study to assess the representation of women and racial or ethnic minorities among investment firms used by the country’s top 50 charitable foundations

For a decade, Knight Foundation has been intentional about identifying high quality, diversely-owned asset managers when investing its endowment. In response to frequent questions from a variety of stakeholders into the performance of the charitable sector regarding this issue — the questions arising from the general lack of data — Knight Foundation asked Global Economics Group to assess the representation of diverse asset managers among foundations.

The study assessed the representation of women- and racial or ethnic minority-owned investment firms (“diversely-owned firms”), among investment firms used by the country’s top 50 charitable foundations.3 The study analyzed available endowment investment data for 26 of the top 50 foundations (“Participating Foundations”) and included only endowment investments managed by investment firms based in the United States, amounting to $63.95 billion in invested assets (“Analyzed AUM”).4 The study found:

- $8.62 billion (13.5%) is invested with diversely-owned firms.

- $6.82 billion (10.7%) is invested with women-owned firms, and $5.93 billion (9.3%) is invested with minority-owned firms, as defined below. Approximately 50% of the $8.62 billion is invested with firms that are both women- and minority-owned; thus, the sum of the two figures is greater than $8.62 billion.5

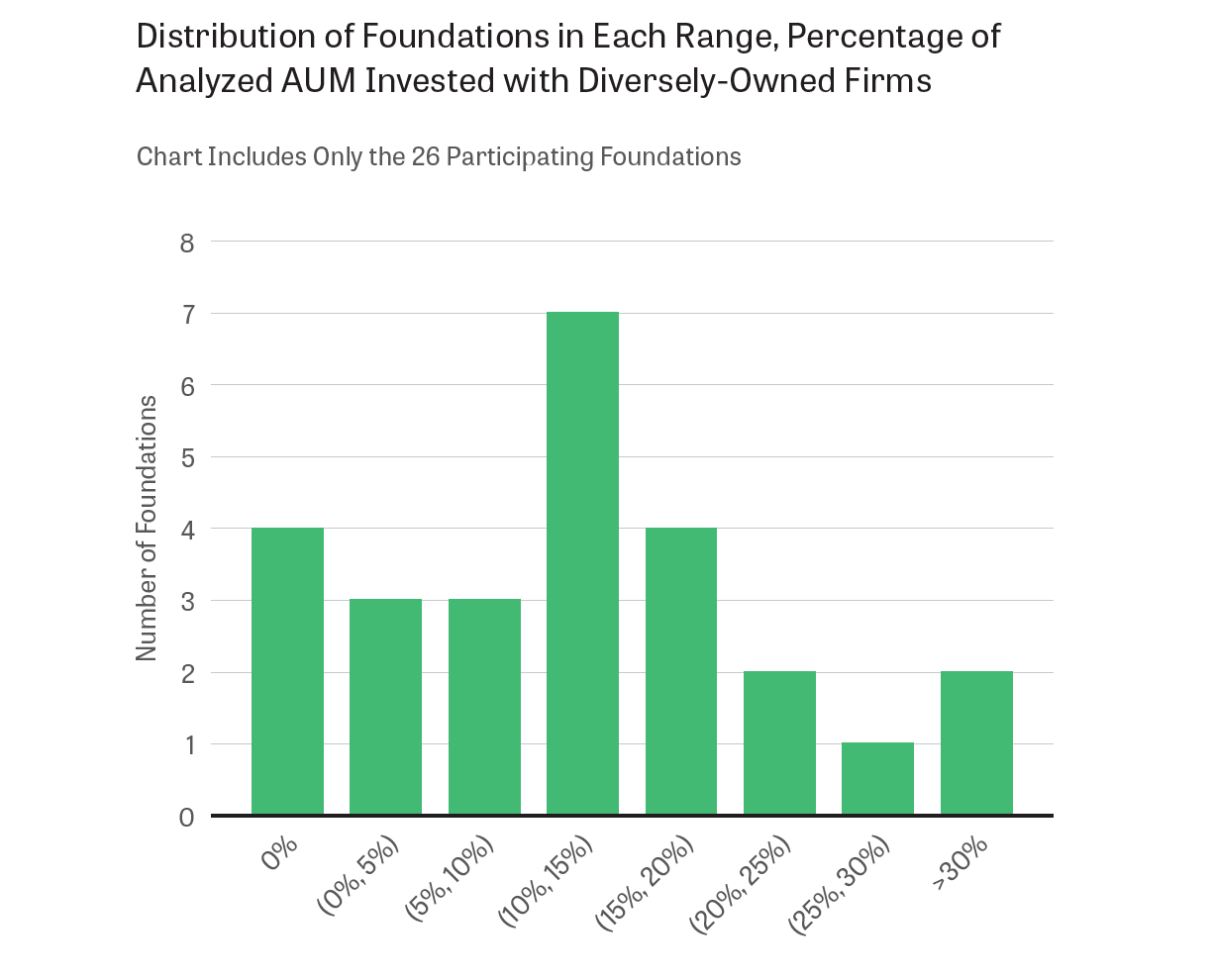

- The average foundation invests 13.3% of its assets in diversely-owned firms, 10.8% in women-owned firms and 9% in minority-owned firms. The median foundation invests 13.5% in diversely-owned firms, 10.9% in women-owned firms and 7.9% in minority-owned firms.

- As the histogram below shows, all but four of the 26 Participating Foundations invest some portion of their assets with diversely-owned firms. Over half invest more than 10% of their assets with such firms. Two foundations invest more than 30% of their assets with diversely-owned firms, with the maximum invested amount equal to 45.9%.

Full Results

The table below shows key results for the top 50 foundations; for full results see the report. We selected the top 50 foundations in terms of the market value of total assets, according to data compiled by Candid in 2019. The top 50 foundations on the Candid list collectively hold $290.32 billion in total assets and consist of the following organizational types:

- 39 independent foundations,

- 7 community foundations, and

- 4 operating foundations.

Of the top 50 foundations, we were able to compile and analyze investment data for 26, either by accessing the data through publicly available sources or through direct voluntary submission by Participating Foundations. Such investment data amounts to $63.95 billion in Analyzed AUM. Of the remaining 24 foundations whose investment data are not included in the study:

- 16 had insufficient publicly available data and declined to participate in the study for a variety of reasons, including contractual nondisclosure agreements with fund managers (classified as: “Declined to participate; insufficient public data for analysis.”),

- 3 had insufficient publicly available data and did not respond to our requests (classified as: “Did not respond to requests; insufficient public data for analysis.”), and

- 5 had investment assets that were mostly or completely invested in assets that do not fit with the purpose of this study, such as art or a family office (classified as: “Investment assets are not relevant to the study. See notes.”).

The remainder of this report provides greater detail on the study in order to ensure that the process we implemented is clear and replicable. This study is purely descriptive, based on a set of clearly defined rules as described in the Methodology section. Appendix A provides a compilation of foundations’ comments of up to 200 words from those foundations that elected to submit a comment. Appendix B provides detailed notes on the available investment data for each foundation.

| Total Assets ($B)1 | Analyzed AUM ($B)2 | Analyzed AUM Managed by Diversely-Owned Firms3 | ||

| 1 | Bill & Melinda Gates Foundation | $51.83 | $1.15 | 3.40% |

| 2 | Ford Foundation | $13.83 | Declined to participate; insufficient public data for analysis. | |

| 3 | Silicon Valley Community Foundation4 | $13.58 | $8.58 ($0.95) | 2.0% (18.4%) |

| 4 | J. Paul Getty Trust | $12.60 | Declined to participate; insufficient public data for analysis. | |

| 5 | Lilly Endowment Inc. | $11.68 | Investment assets are not relevant to the study. See notes. | |

| 6 | The Robert Wood Johnson Foundation | $11.40 | $6.21 | 26.60% |

| 7 | Foundation to Promote Open Society | $10.32 | Declined to participate; insufficient public data for analysis. | |

| 8 | The William and Flora Hewlett Foundation | $9.89 | Declined to participate; insufficient public data for analysis. | |

| 9 | W.K. Kellogg Foundation | $8.60 | Declined to participate; insufficient public data for analysis. | |

| 10 | Bloomberg Family Foundation Inc | $7.85 | Investment assets are not relevant to the study. See notes. | |

| 11 | The David and Lucile Packard Foundation | $7.10 | Declined to participate; insufficient public data for analysis. | |

| 12 | John D. and Catherine T. MacArthur Foundation | $7.00 | $4.80 | 9.90% |

| 13 | The Andrew W. Mellon Foundation | $6.86 | $4.59 | 17.00% |

| 14 | Gordon and Betty Moore Foundation | $6.45 | Declined to participate; insufficient public data for analysis. | |

| 15 | The Leona M. and Harry B. Helmsley Charitable Trust | $5.47 | $4.30 | 19.40% |

| 16 | Walton Family Foundation | $4.93 | $3.44 | 15.40% |

| 17 | Tulsa Community Foundation/ George Kaiser Family Foundation | $4.54 | $1.39 | 0.00% |

| 18 | The JPB Foundation | $4.28 | $1.28 | 19.10% |

| 19 | The Rockefeller Foundation | $4.09 | $2.73 | 14.20% |

| 20 | The Kresge Foundation | $3.95 | $1.97 | 13.60% |

| 21 | Open Society Institute | $3.73 | Declined to participate; insufficient public data for analysis. | |

| 22 | The Duke Endowment | $3.69 | Declined to participate; insufficient public data for analysis. | |

| 23 | The California Endowment | $3.67 | Declined to participate; insufficient public data for analysis. | |

| 24 | Carnegie Corporation of New York | $3.52 | $1.90 | 20.90% |

| 25 | Robert W. Woodruff Foundation | $3.32 | $3.13 | 0.00% |

| 26 | Simons Foundation | $3.32 | Declined to participate; insufficient public data for analysis. | |

| 27 | Greater Kansas City Community Foundation | $3.16 | Investment assets are not relevant to the study. See notes. | |

| 28 | Chan Zuckerberg Foundation | $3.13 | Investment assets are not relevant to the study. See notes. | |

| 29 | John Templeton Foundation | $2.91 | $1.91 | 21.70% |

| 30 | Margaret A. Cargill Foundation | $2.90 | Declined to participate; insufficient public data for analysis. | |

| 31 | Chicago Community Trust4 | $2.83 | $2.50 ($1.06) | 13.4% (31.6%) |

| 32 | The Annie E. Casey Foundation | $2.82 | $1.28 | 14.90% |

| 33 | The New York Community Trust4 | $2.81 | $2.36 ($0.94) | 3.6% (9.1%) |

| 34 | Charles Stewart Mott Foundation | $2.79 | Declined to participate; insufficient public data for analysis. | |

| 35 | Conrad N. Hilton Foundation | $2.69 | Declined to participate; insufficient public data for analysis. | |

| 36 | The Susan Thompson Buffett Foundation | $2.67 | Did not respond to requests; insufficient public data for analysis. | |

| 37 | Shelby Cullom Davis Charitable Fund | $2.52 | Did not respond to requests; insufficient public data for analysis. | |

| 38 | The Wyss Foundation | $2.51 | $0.57 | 0.00% |

| 39 | The William Penn Foundation | $2.49 | $1.60 | 13.10% |

| 40 | The Carl Victor Page Memorial Foundation | $2.49 | $0.58 | 10.30% |

| 41 | Maxcess Foundation Inc. | $2.48 | Did not respond to requests; insufficient public data for analysis. | |

| 42 | Foundation for the Carolinas | $2.48 | $1.51 | 5.20% |

| 43 | Kimbell Art Foundation | $2.46 | Investment assets are not relevant to the study. See notes. | |

| 44 | Cleveland Foundation | $2.45 | Declined to participate; insufficient public data for analysis. | |

| 45 | Ewing Marion Kauffman Foundation | $2.43 | $0.95 | 0.00% |

| 46 | McKnight Foundation | $2.41 | $1.51 | 7.70% |

| 47 | Casey Family Programs | $2.39 | $1.28 | 35.30% |

| 48 | The James Irvine Foundation | $2.37 | Declined to participate; insufficient public data for analysis. | |

| 49 | John S. and James L. Knight Foundation | $2.32 | $1.76 | 45.90% |

| 50 | Richard King Mellon Foundation | $2.32 | $0.69 | 14.10% |

| Total4 | $290.32 | $63.95 ($53.47) | 13.5% (16.1%) |

Notes

1 “Top 100 Active U.S. Foundations by Assets, circa 2017,” sourced by Candid in 2019. Foundation Type as determined by Candid is defined as follows: IN=Independent Foundation, CM=Community Foundation and OP=Operating Foundation.

2 IRS Form 990 (most recent filing for each foundation as of October 1, 2019) and investment firm data provided directly by participating foundations. Analyzed AUM reflects the portion of the foundation’s invested assets for which identifying information on its investment firms is available, and includes only the invested assets that are held and managed by firms that are (1) based in the United States and (2) available in Preqin’s or eVestment’s diversity datasets, or in the diversity data submitted by participating foundations, such that the investment firm’s diversity of ownership profile can be observed. Analyzed AUM, therefore, may not reflect all invested assets. See Appendix B, “Notes on Available Data,” for exceptions and additional information.

3 Preqin Alternative Assets diversity data for private equity, venture capital, private debt, hedge fund, real estate, infrastructure, and natural resource asset classes (as of June 26, 2019). eVestment® diversity data for separate account, commingled trust fund, institutional mutual fund, and exchange-traded fund asset classes (as of August 14, 2019). All eVestment® data Copyright (c) 2019. Diversity data submitted by participating foundations. See Appendix B, “Notes on Available Data,”

4 The figures in parentheses represent only the portion of the public charity’s invested endowment that the organization itself controls. See Appendix B, “Notes on Available Data,” for additional detail on the alternative diversity calculation used for participating public charities in this study. for exceptions and additional information on each foundation.

READ THE FULL REPORT

Assessing diversity in endowment management

REFLECTIONS FROM THE FIELD

Aligning investments with our mission: Diversifying Investment Managers

Diversification can generate better returns

Investing in Diverse Asset Managers: A Performance Imperative

FURTHER READING

Diverse Asset Managers

Diversifying Investments: A Study of Ownership Diversity and Performance in the Asset Management Industry

Research across a multitude of fields and industries has identified the potential economic and social benefits of diversity. Yet the asset management industry continues to struggle with a lack of diversity. Research studies and articles have consistently documented the low level of representation by women and racial/ethnic minorities among asset managers. Analyzing […]

New study shows diverse-owned firms represent a small fraction of asset management industry despite equal performance

Firms owned by women and minorities manage just 1.3 percent of assets in the $69 trillion asset management industry, though their performance is not statistically different from the industry as a whole, a new study from Bella Research Group and the John S. and James L. Knight Foundation has found. […]

Op-Ed: Diversity Pays

This piece was originally published on WealthManagement.com on June 11, 2019. Women- and minority-owned companies manage more than a third of the Knight Foundation’s endowment. It’s paying off. Several years ago, the John S. and James L. Knight Foundation decided to start investing portions of our multi-billion-dollar endowment with firms owned and managed by women […]

Diverse Asset Managers: Opportunities for inclusion

Research shows firms owned by women and minorities manage just 1.3 percent of assets in the $69 trillion asset management industry, though their performance is not statistically different from the industry as a whole, Knight Foundation’s chief financial officer Juan Martinez told the U.S. House Finance Committee’s Subcommittee on Diversity and Inclusion. In fact, a […]

An Intolerance of Failure? Evidence from U.S. Private Equity

This piece was originally published on the Bella Private Markets insights page on June 11, 2019. In our 2018 Diverse Asset Management Study, we show that the asset management industry is characterized by extremely low levels of diversity in ownership. Overall, diverse-owned managers – defined as asset managers with significant female or ethnic minority ownership […]

Photo (top) by Scott Webb on Unsplash.