Hope that the IRS will reconsider outdated media rules

Philanthropic leaders were guardedly optimistic Sunday on the opening day of the Council on Foundations meeting in Chicago that the IRS will reconsider its nonprofit media rules. The outdated guidance, drafted in 1967, has caused multi-year delays and even denials of tax-exempt status for some digital media nonprofits hoping to join the many springing up to try to provide the local accountability journalism being cut by for-profit media.

I was encouraged to see program executives from some of the country’s largest foundations turn out at 8 a.m. on a Sunday morning to discuss tax law. Knight, funder of the Council on Foundations investigation of the issue, hosted the breakfast discussion.

In recent years, IRS agents appear to have fallen back on a 1967 interpretation that “educational” nonprofit media, in a tax-exempt context, must be “distinguishable” from commercial media in production and distribution. That might have worked fine 50 years ago. Daily papers then were without exception daily print products, sold in news racks and delivered to homes. So nonprofits weren’t allowed to do that, and it wasn’t a major issue. But today everyone uses the internet. Production and distribution systems for nonprofit news are identical to those of for-profits. The old rules no longer make sense.

Presenting at the session were media policy expert Steve Waldman, author of the Council on Foundations Nonprofit Media Working Group report The IRS and Nonprofit Media, Toward Creating a More Informed Public; Susan King, dean of the School of Journalism and Mass Communication at the University of North Carolina at Chapel Hill; Andy Hall, founder and executive director of the Wisconsin Center for Investigative Journalism, and Sharon Nokes, attorney from Caplin & Drysdale, the Washington D.C. firm advising the working group. It was Sharon who said that she thought the rules were so obviously outdated she was hopeful the IRS will indeed reconsider them, a process that could take a year or two.

The big mystery is why so many local nonprofits were approved routinely – outlets crucial to civic education, such as the Voice of San Diego, MinnPost and the Texas Tribune, to name a few – until a few years ago, when applications starting getting routed to Washington and the old rules began to be cited. Speculation is that the wave of new applications caused the reconsideration. Or perhaps it was new employees. No one knows for sure. If the rules don’t change, though, future applications will be judged by a legal interpretation conjured nearly half-a-century ago.

Waldman, who moderated the panel, put it well when he compared nonprofit media to nonprofit hospitals. No one would argue that because for-profit hospitals have doctors, nonprofit hospitals shouldn’t. It should be enough that the organization benefits the community, is organized as a nonprofit and follows the section 501(c)(3) rules. For media outlets, those rules mean not endorsing candidates for public office. The working group endorsed those rules.

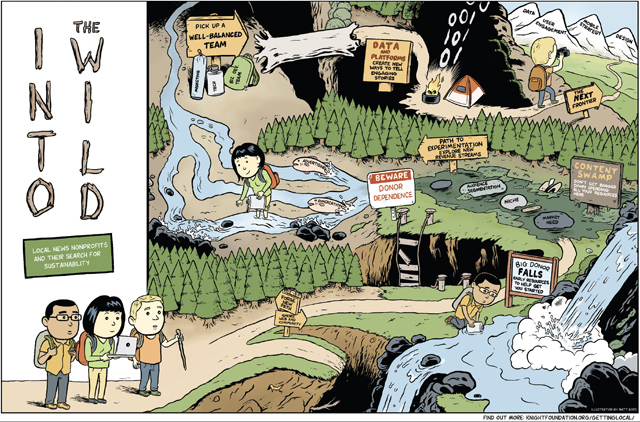

What’s more, Waldman said, IRS agents have discouraged applicants from pursuing business models with “earned revenue” – advertising, for example – even though the law allows it. The working group did not dispute that advertising proceeds should be taxed, Waldman said. It is the pressure to pursue foundation funding as a primary revenue source that is the problem. Historically, the longest surviving nonprofit media are those with multiple revenue streams. So foundations are saying: go out and get other revenue. But the IRS is saying: don’t.

Nokes said journalism qualifies as educational since it meets the law’s overall definition as being “on subjects useful to the individual and beneficial to the community.” Since the problem is not with the law itself, but with the IRS interpretation of the law, no act of Congress would be needed to update the rules, she said.

Hall emphasized the importance of nonprofit media. Though small in number, the new outlets already reach many millions, serving up news and information in all media forms, often partnering with for-profit media. They are producing journalism that is helping communities correct large mistakes, saving money and lives.

Dean King talked about the impact of the local news drought on journalism education. She sees graduates being hired rapidly by national outlets like Bloomberg. But local hiring – which used to form the base of journalism employment, with reporters working their way up to national outlets – is becoming rare. King is among the leading journalism school deans who recently released a letter supporting the Council on Foundations study. Dean Brad Hamm of the Medill School of Journalism, Media, Integrated Marketing Communications, came to show his support for the effort as well.

Kelly Simone, vice president for legal affairs at the Council on Foundations, organized the session. She showed a video from the Columbia Journalism Review web site on the decline in local news. I would recommend it to anyone who wants to understand what’s happening to local news. There’s so much to read, hear and see on the World Wide Web, it can be hard to understand that credible local news on government and major issues such as health, education and the environment actually is shrinking.

This is the media paradox of the digital age: it can be easier to find out about what became of the Navy seal who shot Bin Laden than it is to find out what happened at the local school board meeting. But both Simone and Waldman said they were encouraged by a recent Council on Foundations meeting with treasury department officials who indicated the issue was important.

By Eric Newton, senior adviser to the president at Knight Foundation

Recent Content

-

Journalismarticle ·

-

Journalismarticle ·

-

Journalismarticle ·