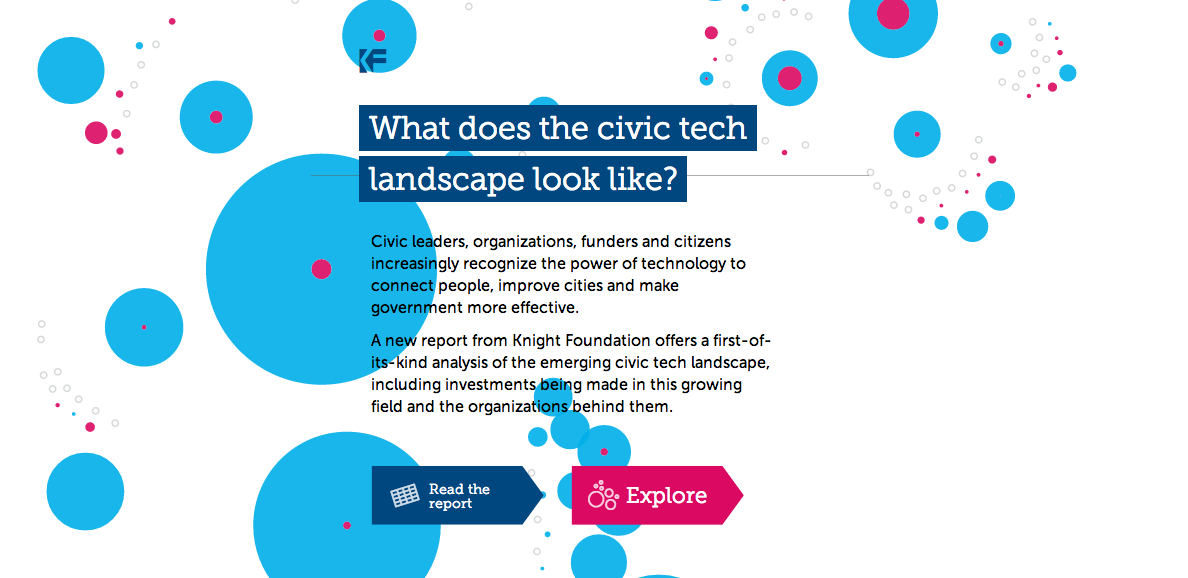

New tools produce better understanding of investments in civic tech

Sean Gourley is co-founder and CTO at Quid, which partnered with Knight Foundation on an analysis of civic tech in a new report, “The Emergence of Civic Tech: Investments in a Growing Field.”

“The Emergence of Civic Tech” began as just an idea, part of a larger conversation with Knight Foundation about new ways that we could use data and algorithms to understand the allocation of capital in emerging fields.

We were struck by the idea that if we could see civic tech as part of a broader ecosystem, then perhaps we could stop making isolated bets with independent grants and develop a larger strategy that would make use of the fact that technologies, investors and public narrative are all interconnected. RELATED Links

“The Emergence of Civic Tech: Investments in a Growing Field” PDF report on Slideshare.net

“Pulling back the curtain on civic tech” by Jon Sotsky on KnightBlog

“Strange bedfellows or yin and yang” by Stacy Donohue on KnightBlog

“Knight Foundation’s civic tech report: why it matters” by Tom Steinberg on KnightBlog

“Civic tech report helps ID opportunities in the field” by Keya Dannenbaum on KnightBlog

“Urban neighborhoods take small steps into ‘civic tech‘” by Patrick Barry on KnightBlog

At Quid this is the kind of question that we like. We have developed software to analyze and visualize unstructured information streams. The software is still very new and is being used by merger and acquisition teams, PR firms and governments to understand complex relationships hidden in data. However we had not had the opportunity to apply these tools to the world of philanthropy. Knight, to its credit, was willing to take on this rather experimental project—and with that we spun up a team of data scientists at Quid to run the software.

Data about foundations and their investments in the technology industry is hard to come by. It’s not recorded in any central place, and when it is recorded it is often in an unstructured format spread across multiple sources. However we were able to use techniques from Open Source Intelligence to uncover data that could be collected from public documents and websites. We were then able to use the Quid analytics platform and Natural Language Processing engines to analyze these data sets to determine what companies were a significant part of the civic tech landscape, what technologies they were employing, how much money they had received, who they had partnered with and who invested in them. But most importantly we could apply network analysis to see how they were all interconnected.

The civic tech landscape involves a high-dimensional set of connections between the companies, investors, people and technologies. With the Quid software we were able to take this complex object and translate it into a two-dimensional network for the Knight Foundation assessment team. This 2-D object represented a simplified projection of the civic tech world, showing all the different organizations and companies in the civic tech space and how they were related to each other.

The network projection revealed the structure of different emerging industries, from peer-to-peer social sharing to voting technologies and many more that don’t yet have names. From this network projection we could then investigate what technology clusters were growing the fastest and which ones were the most mature. We could understand where there were clear winners within a subsector and where private money was dominating philanthropic capital. We could also see clearly from this data the footprint and influence that Knight Foundation was having on the space.

This analysis allowed the team at Knight to pose the deeper strategic questions about how to best allocate capital. Should you invest in dominant technology clusters or focus on helping to grow interesting “white space” technologies? Do you invest in a cluster that has had a low, medium or high proportion of private investment capital? Do you distribute your capital across all the different clusters of organizations or focus on one group? Do you bet on a cluster that has a clear winner or focus on one where the distribution is more uniform? Are different adjacent technology spaces dependent on each other, and if you invest in one do you also need to invest in the other?

These questions get to the heart of ecosystem investment theory. The answers of course depend on the risk profile of the investor and their overall objective. For now we’re moving on to the second phase of the project, to monitor how Knight’s investments have affected the sector and analyze the strategies that have been implemented. There is a lot more learning ahead, but with this project we’ve taken a significant first step towards a deeper understanding of the civic tech landscape and how best to allocate capital to engineer its

Recent Content

-

Community Impactarticle ·

-

Community Impactarticle ·

-

Community Impactarticle ·