Financial Information

Assets and grantmaking

|

Year |

Assets |

New Grants |

Approved | Payout |

|---|---|---|---|---|

| 2023 | $2,603,180,460 | 315 | $195,216,207 | $129,821,000 |

| 2022 | $2,529,635,008 | 270 | $128,159,492 | $114,141,000 |

| 2021 | $3,089,444,600 | 358 | $95,853,815 | $114,231,066 |

| 2020 | $2,674,252,731 | 381 | $71,731,889 | $123,809,334 |

| 2019 | $2,424,843,251 | 488 | $155,146,399 | $133,711,354 |

| 2018 | $2,271,386,220 | 425 | $157,028,547 | $105,335,420 |

| 2017 | $2,473,340,121 | 623 | $88,528,014 | $117,929,820 |

| 2016 | $2,256,756,854 | 482 | $93,859,603 | $127,865,430 |

| 2015 | $2,301,502,477 | 599 | $150,688,190 | $126,796,384 |

| 2014 | $2,443,818,246 | 531 | $148,564,966 | $130,284,911 |

| 2013 | $2,395,608,862 | 434 | $80,483,204 | $120,694,865 |

| 2012 | $2,179,634,480 | 414 | $92,352,685 | $112,063,584 |

| 2011 | $2,192,836,756 | 380 | $77,999,962 | $112,604,594 |

| 2010 | $2,305,269,825 | 318 | $79,299,067 | $104,920,549 |

| 2009 | $2,191,136,614 | 276 | $141,693,088 | $105,887,097 |

| 2008 | $1,972,507,394 | 263 | $140,243,278 | $116,206,414 |

| 2007 | $2,618,700,006 | 290 | $162,068,078 | $121,267,122 |

| 2006 | $2,342,624,401 | 191 | $73,479,294 | $104,310,000 |

| 2005 | $2,142,876,996 | 286 | $78,224,147 | $92,577,000 |

| 2004 | $1,939,340,905 | 329 | $98,274,880 | $90,358,608 |

| 2003 | $1,845,869,048 | 349 | $119,795,670 | $90,400,477 |

| 2002 | $1,718,236,238 | 459 | $80,949,242 | $85,617,981 |

| 2001 | $1,900,829,942 | 319 | $86,433,075 | $85,569,297 |

| 2000 | $2,198,985,122 | 356 | $93,365,465 | $69,983,125 |

| 1999 | $1,888,543,168 | 311 | $69,541,641 | $53,142,772 |

Investment summary

Target Asset allocation (12/31/2024)

- 45% Global Public Equity

- 25% Private Investments

- 15% Hedge Funds

- 10% U.S. Core Bonds

- 5% U.S. TIPS

Diversifying investment management:

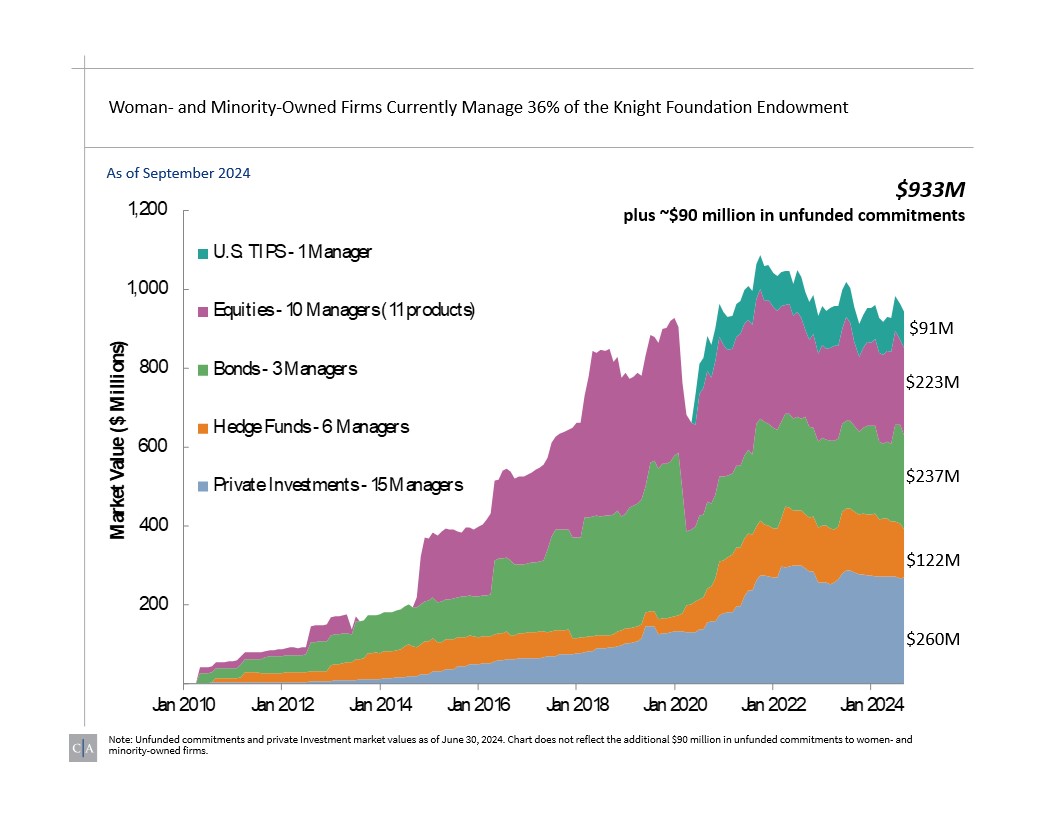

Woman- and minority-owned firms currently manage 36% of the Knight Foundation endowment

Since 2010, Knight Foundation has intentionally sought diversity in the ownership of the asset management firms where it invests. As of September 30, 2024, $0.93 Billion of the foundation, not including approximately $90 million in unfunded commitments, is invested with firms that are substantially- or majority-owned by women or minorities, representing 36 percent of its endowment.

Summary of Knight Foundation Woman- and Minority-Owned Managers

Research

Financial Resources

Tax returns ( Form 990-PF )

For more schedules, email us at [email protected].

Tax Return Investment Appendices

As required by the instructions to the 990PF tax return, Knight Foundation provides a detailed list of all its investment managers investing in Corporate Stock (Part II, Line 10b), Corporate Bonds (Part II, Line 10c) and Other Investments (Part II, Line 13) and the fair market value of those investments.

Though it is not required in preparing the tax return, but in an effort to provide additional transparency, the Foundation has prepared a separate INVESTMENT APPENDIX that provides a detailed list of its investment managers with balances in Savings and Temporary Cash Investments (Part II, Line 2), U.S. and State Government Obligations (Part II, Line 10a) and Other Receivables (Part II, Line 15).

Audited financial statements

More information

For more, visit guidestar.com.